Small Business Sentiment in an Evolving Economic Landscape

The news cycle this year was dominated by economic headlines, with economists, consumers, and business owners all closely monitoring whether the United States would be able to steer clear of a recession in 2023. As the year comes to a close, there is a prevailing sense of optimism. In recent weeks, the economy has been on an upswing. Black Friday broke records, the Dow Jones Industrial Average reached new highs, and the November Consumer Price Index rose only 0.1% , indicating an ease in inflation.

As part of their strategy to manage inflation, the Federal Reserve chose to maintain the benchmark rate at a range of 5.25%-5.5%. During their December meeting, the Fed discussed the state of the economy and expressed optimism for three rate cuts in 2024. The news of potential rate cuts in 2024 sent the stock market soaring, with the Dow Jones Industrial Average climbing 500 points.

While the Fed closely monitors various economic metrics and indicators, consumer sentiment remains a primary focus. In December, consumer sentiment climbed 13%, according to the University of Michigan Surveys of Consumers, following a challenging 2023. Notably, consumers are showing less concern about inflation, as their expectations for the upcoming year have decreased from 4.5% to 3.1%.

Small Businesses Economic Sentiment

Despite the positive recent economic news, business owners continue to feel the lingering economic strain of the past year, reporting persistent challenges. Small businesses are navigating the lasting effects of inflation, the escalating cost of goods and services, and high interest rates, which have become intricately connected to their day-to-day operations. Despite recent positive indicators, business owners are still finding their footing in the economy, balancing the potential for growth in a more favorable economic climate with the need to address the lasting effects of the challenges faced over the year.

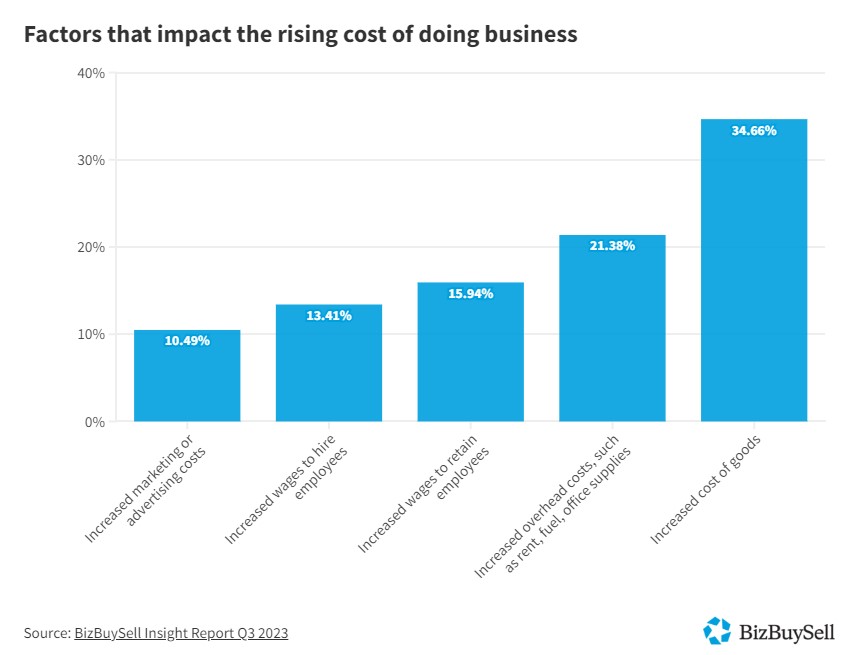

Business owners who have been feeling the impact of higher inflation and rising interest rates in many aspects of their businesses may find relief as costs decline. In BizBuySell’s most recent Insight Report, which tracks the health of the U.S. small business economy, business owners overwhelmingly report the cost of doing business has increased over the last year. Survey results showed that 74.40% of business owners encountered escalating expenses in goods, labor, marketing, and overhead, influencing nearly every facet of their business.

For small business owners managing increasing costs to do business, the prospect of lower interest rates and easing inflation in the coming year is welcome news. The Federal Reserve’s decision to maintain the benchmark rate between 5.25%-5.5% and the announcement of planned rate cuts in 2024 are expected to help ease the financial burden on businesses. With lower borrowing costs, business owners and entrepreneurs have the opportunity to invest in their operations, hire and retain staff, and implement innovative strategies that were previously delayed due to economic challenges in the sector.

The positive economic indicators for 2024 are welcome news for small business owners, who witness the impacts of economic fluctuations firsthand. The recent surge in consumer spending, the buoyant stock market, and the Federal Reserve’s announcement of three anticipated rate cuts in 2024, has instilled a renewed sense of confidence. Business owners, determined to expand their businesses and provide value to their customers, communities, and enterprises, can look forward to a year filled with opportunities.